| Index-linked bond |

|

|

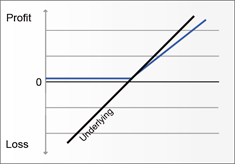

An index-linked bond is a capital protected investment product that combines security with potential growth.

The most common type of index-linked bond is an equity index-linked bond, giving a participation to an equity index. But there are also other types of index-linked bonds giving participation to i.e. commodities, currencies, bonds, hedge funds, strategies or portfolios.

|

|

| Market Expectations |

|

| • |

Rising underlying |

|

| • |

Rising volatility |

|

| • |

Sharply falling underlying possible |

|

| Properties |

|

| • |

Minimum redemption at expiry equivalent to the capital protection |

|

| • |

Capital protection is defined as a percentage of the nominal (e.g. 100%) |

|

| • |

Capital protection refers to the nominal only, and not to the purchase price |

|

| • |

Value of the product may fall below its capital protection during the lifetime |

|

| • |

Unlimited participation in a positive performance of the underlying |

|

| • |

Any payouts attributable to the underlying are used in favour of the strategy |

|

|

| If you want to learn more about this instrument, you can do it at www.ndx.se/education/. |

|

|

|

|